Pre tax profit margin formula

Get 247 customer support help when you place a homework help service order with us. The resulting negative greenhouse gas impact can offset the positive greenhouse gas impact of the biofuels bioliquids or biomass fuels in some cases by a wide margin.

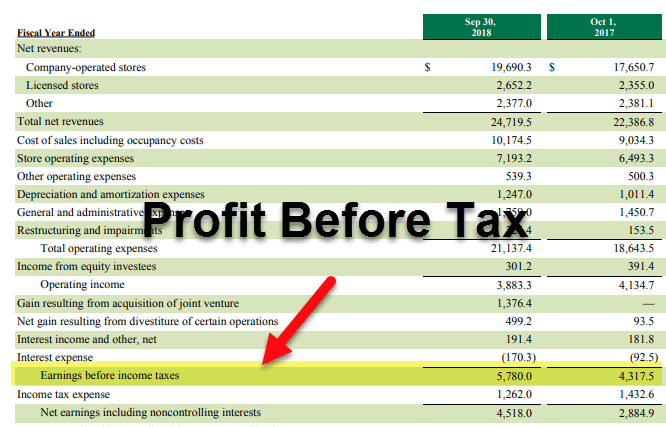

Profit Before Tax Formula Examples How To Calculate Pbt

The inclusion of a Discount Rate as part of the LTV formula accounts for the time value of money and reflects how much a company values receiving payment right now versus at a later date.

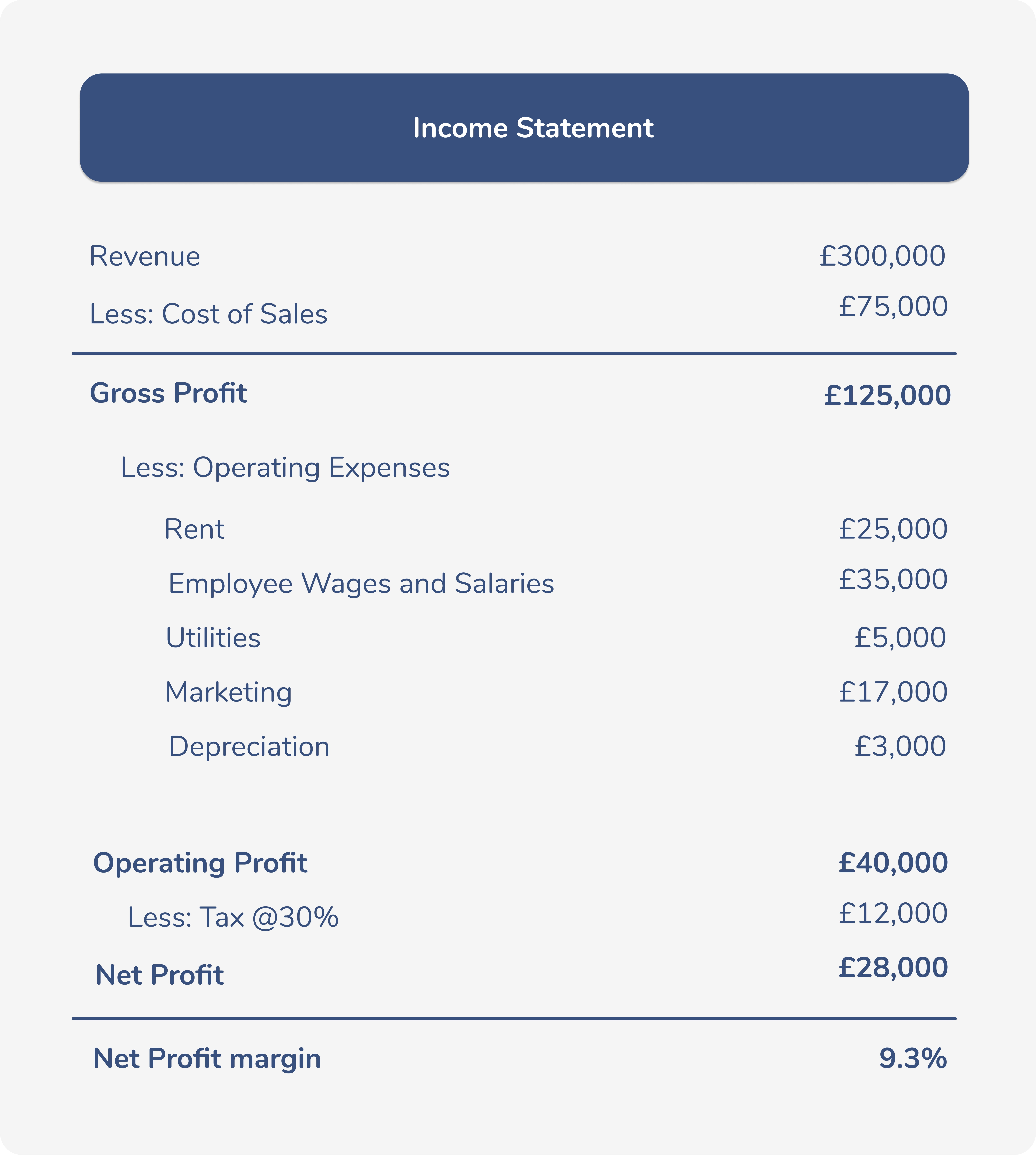

. Divide net income by revenue. Theres also operating profit and pre-tax profit margin. Profit Before Tax - PBT.

Profit in accounting is an income distributed to the owner in a profitable market production process Profit is a measure of profitability which is the owners major interest in the income-formation process of market production. Learn more about all. Discount Rate in LTV.

Net income after taxes NIAT is an accounting term most often found in a companys annual report that is meant to show the companys definitive bottom line for. Profitability ratios are a class of financial metrics that are used to assess a businesss ability to generate earnings compared to its expenses and other relevant costs incurred during a specific. The best opinions comments and analysis from The Telegraph.

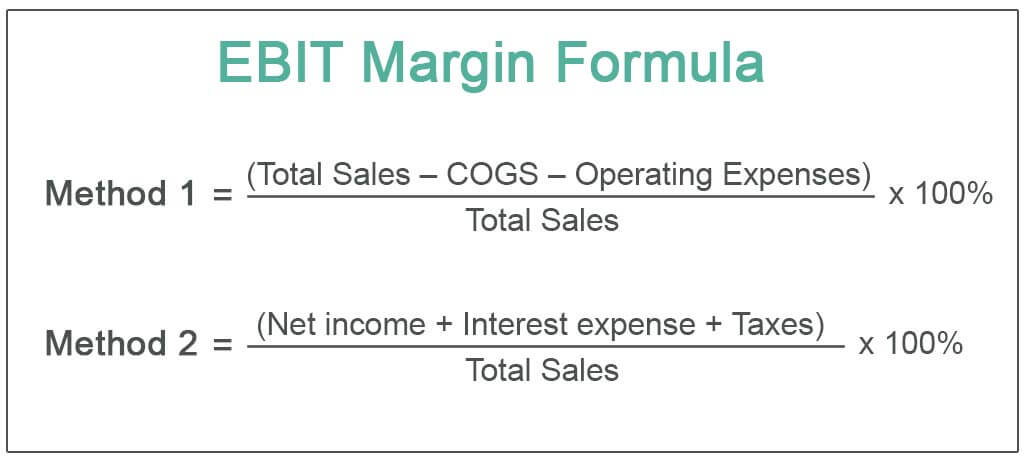

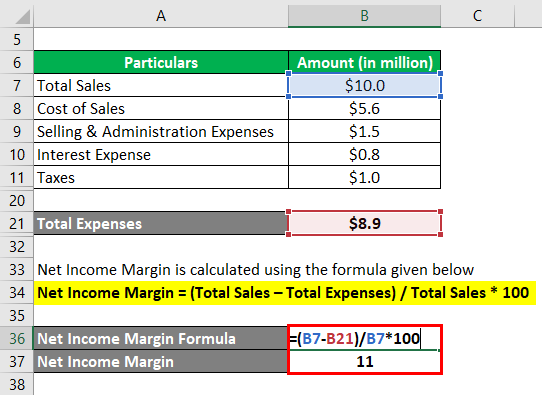

10 to 15 Early-Stage Start-Ups. Pre-Tax margin Formula Earnings Before Tax But After Interest EBTRevenue. Net Profit Margin Ratio.

Cost of Debt Calculation Example 2 For the next section of our modeling exercise well calculate the cost of debt but in a more visually illustrative. A companys after-tax profit margin is important because it tells investors the. See My Options Sign Up.

Operating Profit Margin is one of the measures to calculate the profitability of a company. Refer to the formula below to calculate first your net income and then your net profit margin. Production volume must be tracked across a specified period.

Net Profit Margin refers to the percentage of profit a company generates from its revenues. After-Tax Cost of Debt 56 x 1 25 42. To arrive at the after-tax cost of debt we multiply the pre-tax cost of debt by 1 tax rate.

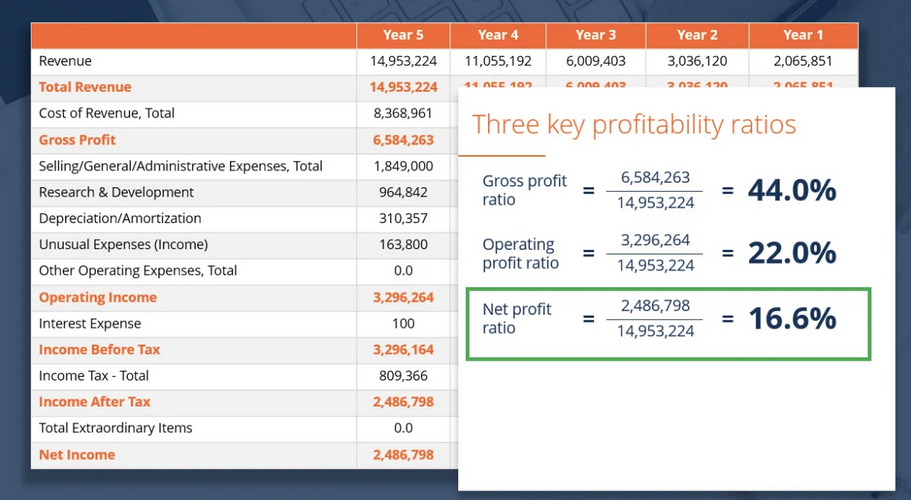

Like other profitability ratios Gross Profit Margin Pre-tax Profit Margin and Net Profit Margin Operating Margin throws more light on how profitable a company isLet us take a deep dive into what this measure of profitability is. Get all the latest India news ipo bse business news commodity only on Moneycontrol. Net profit margin measures how much profit your business generated as a.

The Definitive Voice of Entertainment News Subscribe for full access to The Hollywood Reporter. To make the margin a percentage multiply the result by 100. Tinas T-Shirts is based out of Carmel-by-the-Sea California.

After-tax profit margin is a financial performance ratio calculated by dividing net profit after taxes by revenue. There are several profit measures in common use. This lets us find the most appropriate writer for any type of assignment.

Please contact Savvas Learning Company for product support. Lets use an example which calculates both. Net Income After Taxes - NIAT.

We also do not at any point resell any paper that had been previously written for a client. Every essay is written independent from other previously written essays even though the essay question might be similar. Net income or net profit may be determined by subtracting all of a companys.

Pre-Tax Cost of Debt 28 x 2 56. Gross Profit Margin Total Revenue Cost of Goods SoldTotal Revenue x 100. Total Costs Total Fixed Costs Total Variable Costs.

Pre-tax profit is a variation of operating profit. 8 to 10 Late-Stage Private Companies. We do not offer pre-written essays.

Pre-Tax Profit Margin. Not Your Fathers Catalog Music Streaming has made catalog music more important than ever - but the catalog thats growing isnt necessarily what youd expect. All our essays and assignments are written from scratch and are not connected to any essay database.

Income formation in market production is always a balance between income generation and. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. The final step is to calculate the marginal cost by dividing the change in total costs by the change in quantity.

Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. What is Operating Profit Margin. Where Pre-Tax Profit is nothing but Operating Profit less interest.

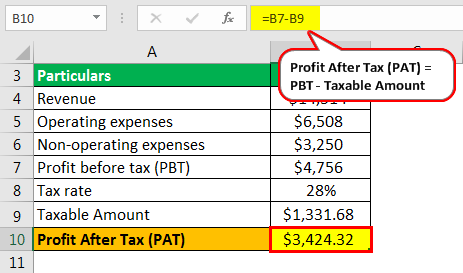

Profit before tax PBT is a profitability measure that looks at a companys profits before the company has to pay corporate income tax by deducting all expenses from. Q3 2021 Twelve Months Trailing Rank. The formula to calculate gross profit margin as a percentage is.

The full carbon effects of such conversion should therefore be taken into account in calculating the greenhouse gas emissions savings of particular biofuels bioliquids and. Next the change in total costs and change in quantity ie. Her business has not been in operation very long only a year.

Definition Formula Example and More Net Profit Margins by Industry. In finance a forward rate agreement FRA is an interest rate derivative IRDIn particular it is a linear IRD with strong associations with interest rate swaps IRSs. The standard discount rates range around.

Origin of Old Firm The origin of the term is unclear but may derive from the two clubs initial match in which the commentators referred to the teams as like two old firm friends or alternatively may stem from a satirical cartoon published in The Scottish Referee sports newspaper prior to the 1904 Scottish Cup Final between the sides depicting an elderly man. It deducts depreciation amortization and includes other income loss. Profit margin is a profitability ratios calculated as net income divided by revenue or net profits divided by sales.

Pre Tax Profit Margin Formula And Ratio Calculator Excel Template

Pretax Profit Margin Formula Meaning Example And Interpretation

Net Profit Margin Formula And Calculation Wise Formerly Transferwise

Net Profit Margin Formula And Ratio Calculator Excel Template

Guide To Profit Margin How To Calculate Profit Margins With Examples

Pretax Profit Margin Formula Meaning Example And Interpretation

Ebit Margin Formula Excel Examples How To Calculate Ebit Margin

Pretax Profit Margin Formula Meaning Example And Interpretation

Profit Before Tax Formula Examples How To Calculate Pbt

Net Profit Margin Formula And Ratio Calculator Excel Template

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Pretax Profit Margin Formula Meaning Example And Interpretation

Net Profit Margin Prepnuggets

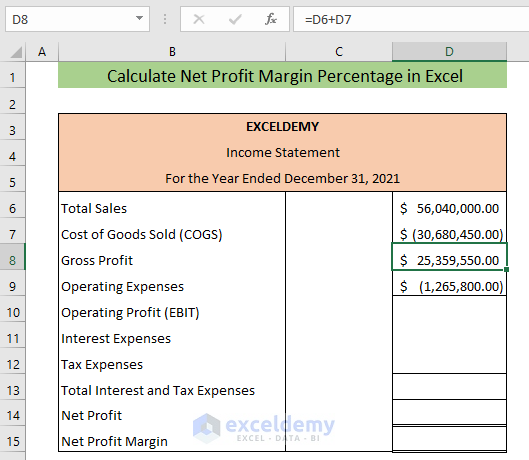

How To Calculate Net Profit Margin Percentage In Excel Exceldemy

Pre Tax Profit Margin Formula And Ratio Calculator Excel Template

Profit Margin L Most Important Metric For Financial Analysis

Profit After Tax Definition Formula How To Calculate Net Profit After Tax